- What we do

-

-

Digital Engagement Banking

CBX is built to enable banks to run lean, experiment, and operate with speed and agility while focusing technology resources on innovation.

Products

Combining products for fulfilling holistic needs of the customer.

Platforms

Combining products, solutions and capabilities from multiple providers.

Banking As A Service

Embed services within a customer’s ecosystem, and reshaping consumption patterns of end customers.

-

-

-

- Company

-

- Knowledge

-

- Contact Us

News Flash

National Bank of Kuwait (NBK) expands partnership with Intellect Global Transaction Banking

Read Full PR News FlashiGTB's CTX Platform Successfully Deployed by a leading European Bank in France

Read Full PR News FlashiGTB Pulse Newsletter February 2024

Read More News FlashHighlights of Transformation Strategies for Transaction Banking in Philippines & Thailand

Know More News FlashThe Perfect Storm - Opportunities and Threats on the Horizon

Read More

Embark on a voyage of discovery

iColumbus.ai leverages native artificial intelligence to harness the power of paperless trade, the openness of a digital marketplace, advanced contextual data analytics, and superior limits management and risk distribution. All available through superb omni-channel UX, for sustainable trade and supply chain finance.

The iColumbus.ai Advantage

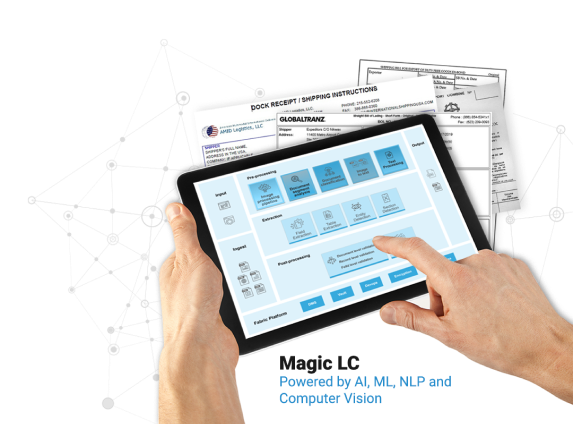

Artificial Intelligence for Smart Data Capture & Data Compliance

Shipping document scanning

Intelligent document checking

Cognitive capture

Rule-based validation for discrepancies

Guarantee

SBLC

Build with the Best Technologies

- Data enrichment via APIs

- AI Model Classification

- Into-the-loop Verification

- Integration for structured output

- ML Contextual Data Extraction

- Normalisation w/semantic maps

- Configurable rule based Validation

What’s special about iColumbus.ai?

Five magic accelerators to delight clients and increase revenue

AI based smart data capture

Advanced analytics dashboard

Integrated trade and supply chain

Digital marketplace and open APIs

Risk distribution and limits management

AI based smart data capture

Artificial Intelligence for smart data capture and compliance

Save time by intelligent extraction of data from documents into XML and into the application screen. Reduce risk as data from the documents can be used for AML/sanction screening. Interact with your clients by adding annotations and exchanging documents revisions instantly with your clients as needed

“Capturing data has never been this easy Less Paper. Less Work. More Trade.” – Tim Operations Manager at iGTBank

Advanced analytics dashboard

Bird’s eye view with the contextual advanced analytics dashboard

Spot existing and emerging problems with the Contextual Advanced Analytics Dashboard, which helps monitor and process pending transactions for a variety of roles. Display the detail to hone in on the problem using Drill Down. Use Drill Up to review the summary.

“Monitoring revenue and making informed decisions has never been this easy!” – Jessica Head of Trade Operations at iGTBank

Integrated trade and supply chain

Using the right solution matters

Clients can act as both buyers and sellers across a single unified interface. Banks and corporates alike can enjoy the strong mutual benefits of a sophisticated interface that automates tracking, messaging, and onboarding through simple workflow orchestrations.

“I need to future-proof my technology investments in order to sustain a cutting edge over the competition.” – Adil Head of Trade & Supply Chain, iGTBank

Digital marketplace and open APIs

Embrace evolving technologies through the Digital Marketplace and Open APIs

“I can leverage the full power of the trade ecosystem, connecting to a wide range of strategic partners” – Stefan Head of Innovation at iGTBank

Risk distribution and limits management

No need to shy away from big-ticket transactions with Risk Distribution

Distribution can be enabled on a funded or unfunded basis. Trade is a high-value, low-volume business with a big impact on the bank’s balance sheet management. It is document heavy and labor-intensive. Intellect streamlines the entire process. Enables effective exposure management through asset sales to banks and insurance companies.

“All the benefits, none of the risk. I am able to reduce my capital allocations and stretch credit lines to take on additional business” – Louis Head of Trade Assets Risk Management at iGTBank

Explore the magic of Artificial Intelligence to accelerate your global trade

What’s iColumbus.ai made of?

Five magic accelerators to delight clients and increase revenue

5

Composable

Cloud Native

Technologies

Microservices and Open Banking API Intergration

World class low/no-code integration and interfacing engine

Contextual Banking Experience

The superb omni-channel context-sensitive

front end

Intelligent Document Exchange

Native engine for Artificial intelligence &

Machine Learning

Digital Partner Ecosystem

Covering Compliance, trade analytics, smart contracts & more

Integrated Security Services Suite

Modern identification, authorisation, SSO and entitlement

5

Composable

Cloud Native

Technologies

Microservices and Open Banking API Intergration

World class low/no-code integration and interfacing engine

Contextual Banking Experience

The superb omni-channel context-sensitive

front end

Intelligent Document Exchange

Native engine for Artificial intelligence &

Machine Learning

Digital Partner Ecosystem

Covering Compliance, trade analytics, smart contracts & more

Integrated Security Services Suite

Modern identification, authorisation, SSO and entitlement

5

Composable

Cloud Native

Technologies

Contextual Banking Experience

The superb omni-channel context-sensitive front end

Intelligent Document Exchange

Native engine for Artificial intelligence & Machine Learning

Microservices and Open Banking API Intergration

World class low/no-code integration and interfacing engine

Integrated Security Services Suite

Unearth the ‘Blind spots’ to design smoother implementations and sustainable frameworks

Digital Partner Ecosystem

Leverage design thinking approach to solve complex fintech problems

iGTB Spotlight. Fill me in on the latest

"Our motto is Mr.

"Going live with iGTB’s Digital Trade Finance platform is an important step for our customers and our bank. iGTB’s technology helps us to harmonize the trade finance processes across the Raiffeisen Sector and will thus reduce complexity and overall costs. The platform is flexible enough to accommodate customer demands of all kinds and we are very excited about the implementation of the new digital customer front-end attached to iGTB’s Digital Trade Finance back-end solution."

Felix Mayr,

Head of Transaction Banking,

Raiffeisenlandesbank Niederösterreich-Wien AG

Raiffeisenlandesbank Niederösterreich-Wien AG

"We will be able to deliver a scalable and automated trade finance solution that removes bottlenecks for our clients both domestic and international and enables their sales with minimal cross-border issues. We are convinced that iGTB’s Digital Trade Finance platform has helped us to strengthen our current offering in the market."

Mr. Hannes Meixner,

Head of Trade Finance,

Raiffeisen-Landesbank Steiermark AG

Raiffeisen-Landesbank Steiermark AG

"Our motto is “With this latest state-of-art digitized SCF product, we are now live with a few large corporates and many more in the pipeline. With this product we will be augmenting our relationship with Large Corporate Customers and SME clients. This product will help us enter new Large Corporate Relationship and MSME clients. In line with our Prime Minister’s “Digital India”, “Make in India”, “Stand-Up India” initiatives, this solution will augment the strength of the companies that are driving the country’s growth – opening up new financing opportunities for companies of all sizes via a cutting-edge digital product."

Mr. Litesh Majethia,

Head of Supply Chain Finance,

Bank of Baroda,

Bank of Baroda,

Analysts and Partners Speak

In The News

Always under the spotlight. Catch our latest ideas here.

Perspective